In recent years, the Government of India has made it mandatory to link the Aadhaar card with various important documents, including the PAN (Permanent Account Number) card. The linking process is relatively simple and can be done online. This article will guide you through the step-by-step procedure of linking your Aadhaar to PAN card online in India, ensuring compliance with the government’s regulations.

Table of Contents

Introduction

The Aadhaar card is a unique identification number issued by the Unique Identification Authority of India (UIDAI), while the PAN card is a ten-digit alphanumeric identification number issued by the Income Tax Department of India. Linking Aadhaar to PAN card is essential to streamline government processes, prevent tax evasion, and promote transparency in financial transactions.

Why Link Aadhaar to PAN Card?

Linking Aadhaar to PAN card has become mandatory to curb tax evasion and duplicate PAN cards. The linkage helps in verifying an individual’s identity, preventing individuals from holding multiple PAN cards, and ensuring accurate income tax assessment. It also facilitates the seamless filing of income tax returns and enables the government to track financial transactions effectively.

How to link PAN card with Aadhaar via SMS?

- Start the messaging application for your smartphone.

- Create a message, and then type the following: UIDPAN (12 Digit Aadhaar Number) (10 Digit PAN Number)

- For example, if your Aadhaar number is 123456789012 and your PAN is ABCDE1234F

- then the SMS should be sent in the following format: UIDPAN 123456789012 ABCDE1234F

- Send this message to 56161 or 567678

- You will receive an update regarding the PAN-Aadhaar status via sms to your mobile number.

Prerequisites for Linking Aadhaar to PAN Card via Online

Before you proceed with linking your Aadhaar to PAN card online, make sure you have the following prerequisites:

- Valid Aadhaar card

- Valid PAN card

- Active internet connection

- Access to a computer or mobile device

- Mobile number registered with Aadhaar card

Step-by-Step Guide to Link Aadhaar to PAN Card Online

Follow these steps to link your Aadhaar to PAN card online:

Step 1: Visit the Income Tax e-Filing Portal

Go to the official Income Tax e-Filing portal, Click Here to Link Aadhaar Card with Pan Card

Step 2: Enter Personal Details

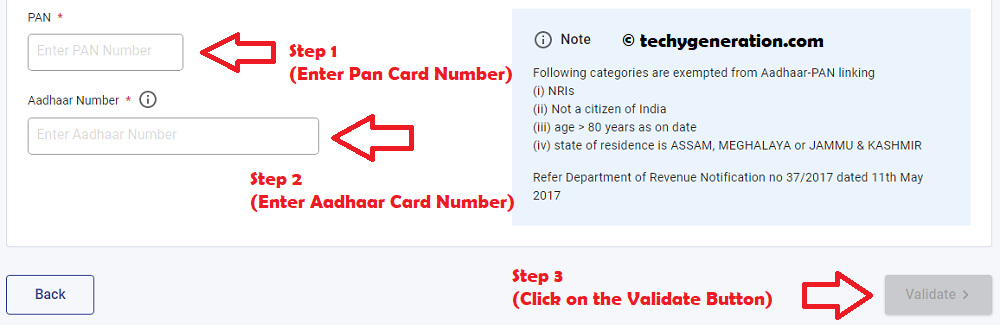

On the e-Filing portal, click on the “Link Aadhaar” option available under the “Quick Links” section. Provide the following details:

- Enter your PAN Card Number

- Enter your Aadhaar Card Number

Step 3: Verify Aadhaar Details

After entering the details, click on the “Validate” button. The system will verify the details provided with the UIDAI database.

Step 4: Confirmation of Aadhaar-PAN Linkage

Upon successful linkage, a confirmation message will be displayed on the screen. You will also receive an email and SMS on your registered email address and mobile number, respectively.

Benefits of Linking Aadhaar to PAN Card

Linking your Aadhaar to PAN card offers several benefits, including:

- Easier income tax return filing

- Elimination of duplicate PAN cards

- Simplified verification of identity and financial transactions

- Enhanced transparency and accountability in tax matters

- Reduced tax evasion and improved compliance

Common Issues and Troubleshooting

While linking Aadhaar to PAN card, you may encounter certain issues. Here are a few common problems and their solutions:

- Incorrect details: Ensure that the details entered match those on your Aadhaar and PAN cards. Cross-check for any spelling mistakes or errors.

- OTP not received: If you do not receive the OTP, click on the “Resend OTP” option. Alternatively, check if your mobile number is correctly registered with Aadhaar.

- Mismatched records: In case of a mismatch between your Aadhaar and PAN records, contact the UIDAI or the Income Tax Department for resolution.

Frequently Asked Questions (FAQs)

Is it mandatory to link Aadhaar to PAN card?

Yes, it is mandatory to link your Aadhaar card with your PAN card as per the government regulations.

Can I link multiple PAN cards to a single Aadhaar?

No, you can link only one PAN card with a single Aadhaar card.

What happens if I fail to link Aadhaar to PAN card?

Failure to link Aadhaar to PAN card may result in the invalidation of your PAN card, which can lead to difficulties in financial transactions and income tax filing.

Can I link Aadhaar to PAN card offline?

Yes, you can link Aadhaar to PAN card offline by submitting a duly filled and signed form to the designated PAN service centers.

Can I unlink Aadhaar from PAN card if needed?

No, currently, there is no provision to unlink Aadhaar from PAN card once it has been linked.

Conclusion

Linking your Aadhaar to PAN card online is a straightforward process that helps in promoting transparency and compliance with tax regulations in India. By following the step-by-step guide provided in this article, you can easily complete the Aadhaar-PAN linkage, ensuring hassle-free income tax filing and avoiding any legal complications.